Feb

VAT Reverse Charge for the Construction Industry – FAQ’s

When does it come into effect?

Introduced from 1st March 2021

Who does it effect?

VAT registered businesses who work in the Construction Industry Scheme (CIS)

Why does it exist?

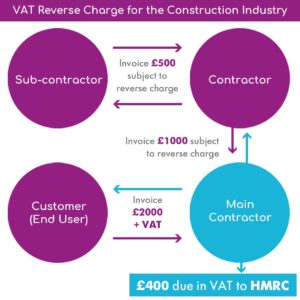

Designed to combat fraud. There have been instances where sub-contractors are charging VAT to contractors and are not VAT registered. The contractors would then reclaim the VAT but sub-contractors were fraudulently pocketing the money rather than paying it over to HMRC.

I’m a VAT registered sub-contractor and usually work for contractors, what does this mean for me?

If you are VAT registered and a CIS sub-contractor, you will no longer charge VAT to your VAT registered CIS contractors. You will need to obtain a copy of their VAT number to confirm they are registered and you can check their VAT number through the following link. https://www.gov.uk/check-uk-vat-number

Please email team@theonlineaccountant.com if you want a template questionnaire to pass onto your customers to verify that your sales invoices to them will be/won’t be subjected to the reverse charge VAT.

Assuming your customer is VAT registered (and not the end user/customer), instead of charging VAT on your sales invoices, you need to state that your customer is responsible for the VAT through the reverse charge mechanism and show what VAT rate should be applied.

Example of sub-contractor invoice to a contractor:

I’m a contractor and have received an invoice from a sub-contractor with VAT on, should I pay this to them?

No, explain to them that you are not the end user/customer, that you are VAT registered and ask them to issue you a reverse charge invoice without VAT explaining that you will account for the VAT.

I’m a contractor and working directly with the end customer, should I charge VAT?

Yes, if you are a VAT registered contractor, the final invoice to the customer should have VAT charged on it at the appropriate rate.

What construction services does the VAT reverse charge apply to?

According to HMRC, the reverse charge applies to the following, with the inclusion of any services that form an integral part of the items below, or are preparatory to them, or are for rendering them complete (for example, site clearance or earth-moving excavation):

- construction, alteration, repair, extension, demolition or dismantling of buildings or structures (whether permanent or not), including offshore installations

- construction, alteration, repair, extension or demolition of any works forming, or to form, part of the land, including (in particular) walls, roadworks, power lines, electronic communications apparatus, aircraft runways, docks and harbours, railways, inland waterways, pipelines, reservoirs, water mains, wells, sewers, industrial plant and installations for purposes of land drainage, coast protection or defence

- installation in any building or structure of systems of heating, lighting, air conditioning, ventilation, power supply, drainage, sanitation, water supply or fire protection

- internal cleaning of buildings and structures, so far as carried out in the course of their construction, alteration, repair, extension or restoration

- painting or decorating the internal or external surfaces of any building or structure

Remember that the reverse charge applies to the services listed above plus any construction materials used directly for those services.

This is different to the CIS scheme, which does not cover materials

If there are any queries at all with anything to do with the VAT reverse charge, then please do not hesitate to drop as an email at team@theonlineaccountant.com

Sorry, the comment form is closed at this time.